How Do Real Estate Developers Secure Financing for Projects?

In the dynamic world of real estate development, securing financing is crucial for turning vision into reality. From residential complexes to commercial skyscrapers, every project requires substantial investment. But how do developers navigate the intricate landscape of funding to ensure their projects come to fruition? Let’s delve into the strategies and mechanisms behind securing financing for real estate projects.

How Real Estate Developers Secure Financing for Projects?

Understanding the Landscape

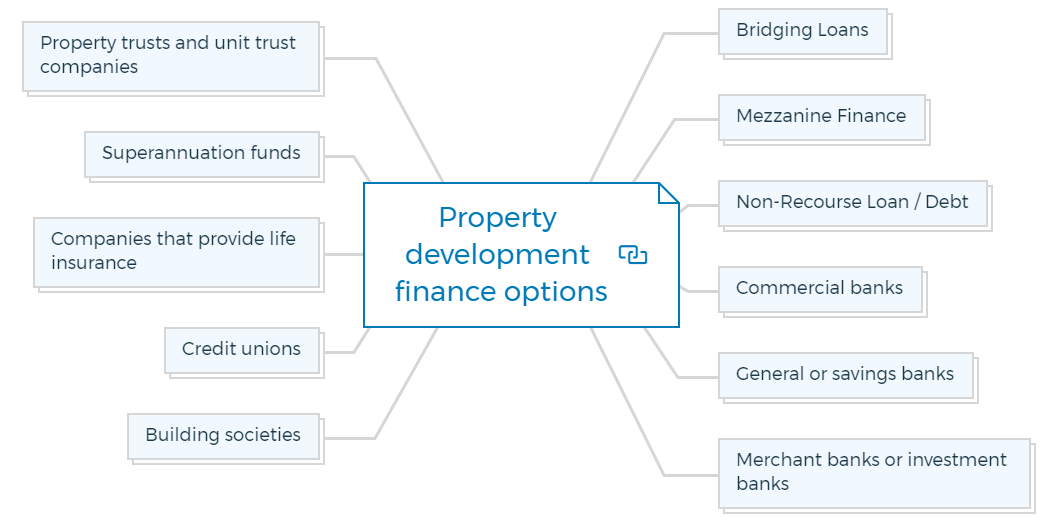

Before delving into the methods of securing financing, it’s essential to grasp the diverse sources available. Real estate developers typically rely on a combination of debt and equity financing. Debt financing involves borrowing funds from lenders, such as banks or private investors, with a promise to repay with interest. Equity financing, on the other hand, entails selling ownership stakes in the project to investors in exchange for capital.

Building Relationships with Lenders

Establishing strong relationships with lenders is paramount for real estate developers. These relationships are often cultivated over time through consistent communication, transparency, and a track record of successful projects. Developers must demonstrate their credibility and competence to instill confidence in lenders regarding the viability of their projects.

Bank Loans and Mortgages

One of the most common forms of debt financing in real estate development is bank loans or mortgages. Developers approach banks and financial institutions to secure loans, leveraging the value of the property as collateral. The terms of these loans vary depending on factors such as the developer’s creditworthiness, the project’s risk profile, and prevailing market conditions.

Private Equity and Venture Capital

In addition to traditional bank loans, developers may seek funding from private equity firms and venture capital investors. These investors provide capital in exchange for equity ownership in the project. Private equity and venture capital can be particularly advantageous for ambitious projects like flats in Chennai for Sale with high growth potential but may come with more stringent terms and conditions.

Crowdfunding and Peer-to-Peer Lending

With the advent of technology, crowdfunding platforms and peer-to-peer lending networks have emerged as alternative sources of financing for real estate projects. Developers can raise capital from a large pool of individual investors, often with lower barriers to entry compared to traditional funding avenues. Crowdfunding platforms allow developers to showcase their projects to potential investors and solicit contributions in exchange for various incentives or returns.

Government Incentives and Subsidies

Government incentives and subsidies play a significant role in facilitating real estate development projects, particularly in areas targeted for revitalization or economic growth. Developers may benefit from tax credits, grants, or low-interest loans provided by local, state, or federal government agencies. These incentives not only reduce the financial burden on developers but also serve broader economic and social objectives.

Conclusion

Securing financing for real estate projects requires a multifaceted approach that encompasses traditional banking channels, alternative funding sources, and strategic partnerships. By understanding the diverse landscape of financing options and building strong relationships with lenders and investors, developers can navigate the complexities of the real estate market with confidence. Ultimately, successful financing strategies are essential for bringing ambitious real estate projects from concept to completion.